The biggest question everyone wants to know is when travel will return, and when the market will get back to where it was in early 2020. The answer is a little deeper than just a simple date, but it varies on location, region, and chain scale. There are also positives and some good news that need to be addressed before simply putting a date on a distant calendar for when we will all be able to breathe a little easier.

Where the Market Stands Now

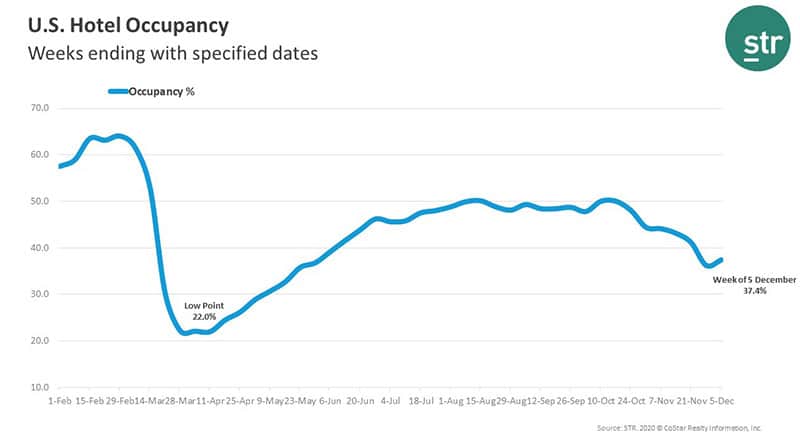

A small dip after the Thanksgiving holidays has left us with a current average occupancy of 37.4%, ADR of $86.21, and RevPAR of $32.23, according to the December 5th STR report.

The Good News

Current estimates are that we will return to pre-COVID occupancy levels in either 2024 or 2025, but that is compared to the growing rate that we saw in 2018 and 2019. That doesn’t mean we will be in this same position for the next three or four years, but rather, it is a ray of optimism that the industry WILL come back to what it was previously. Until that time, hoteliers will start to breathe a bit easier come Q3 or Q4 of 2021. The occupancy and RevPAR rates in 2013/2014, for example, were nothing to be upset about, and we should be pretty close to those numbers by the end of 2021 or early 2022.

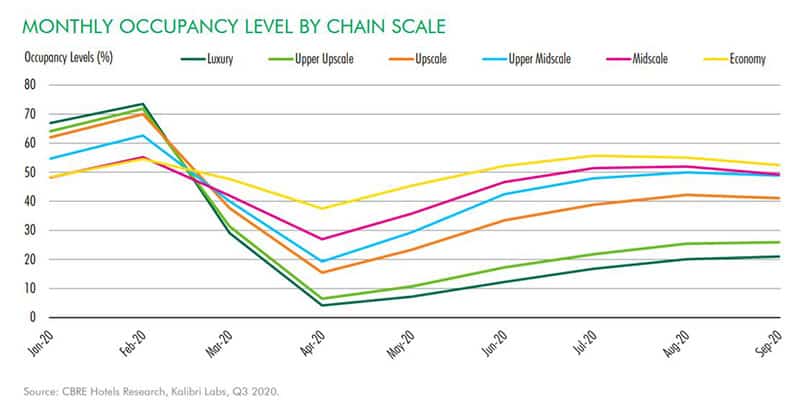

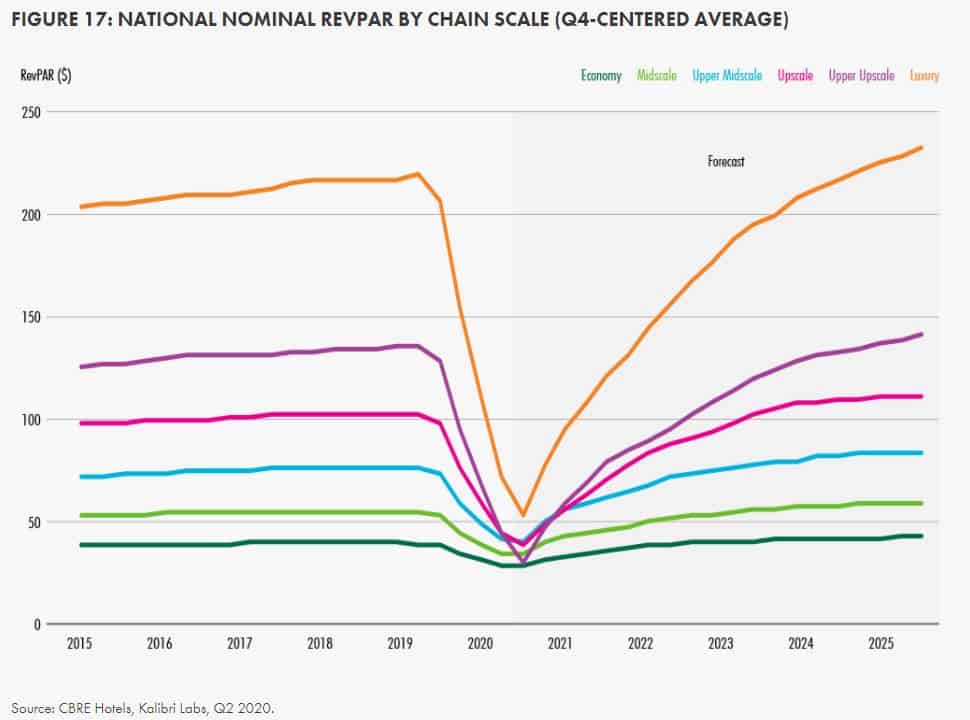

In certain sectors, the market has already returned. Again, it depends and varies very much on the region and chain value, but the outlook is good. This chart from CBRE’s Q3 2020 report shows in detail the occupancy rates for the first three quarters of 2020. For example, Luxury and Upper Upscale chains have taken the biggest hit, but that means that they will have the highest recovery. Economy and Midscale, however, took the smallest amount of decrease, and are already almost recovered in occupancy rates.

In other good news, the United States has been the leader in new hotel openings between March and September. According to a report published on October 1st from STR, the U.S. opened 521 properties accounting for 55,395 rooms over the seven-month period. That means that not only are we ready to make a comeback, but we are also already doing so.

Looking Forward

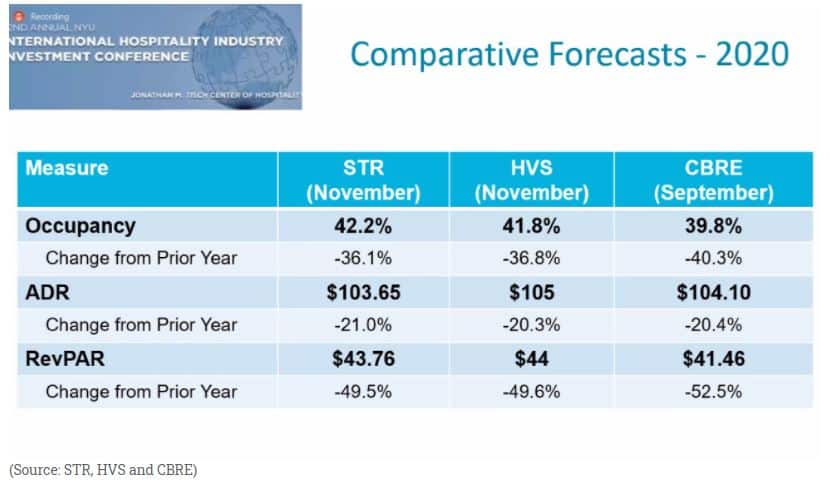

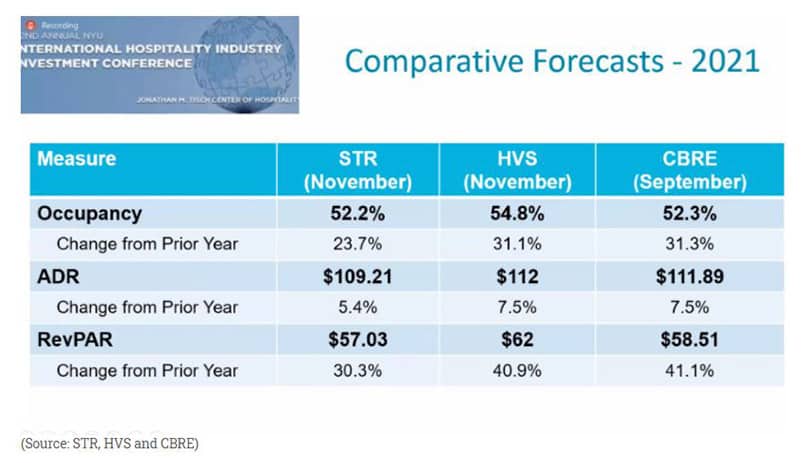

While 2024 and 2025 seems like a long way off, we are expected to cross the 50% occupancy line by Q3 of 2021. HVS, STR, and CBRE are all forecasting a level above 52% come November of 2021, according to this P&L article from Hotel News Now. That is at least a 23% increase from this past November, showing marked improvements.

We’ve mentioned recovery by chain scale before, and this report from CBRE shows a bit more on when each scale is expected to recover fully to pre-COVID levels. Again, this is an average. It can vary on destination type and region as well. For instance, we are seeing a rising trend in small-town or more rural area tourism, and locations that are more outside based. State parks and beaches have been a big draw this year, and will continue to rise above their previous levels.

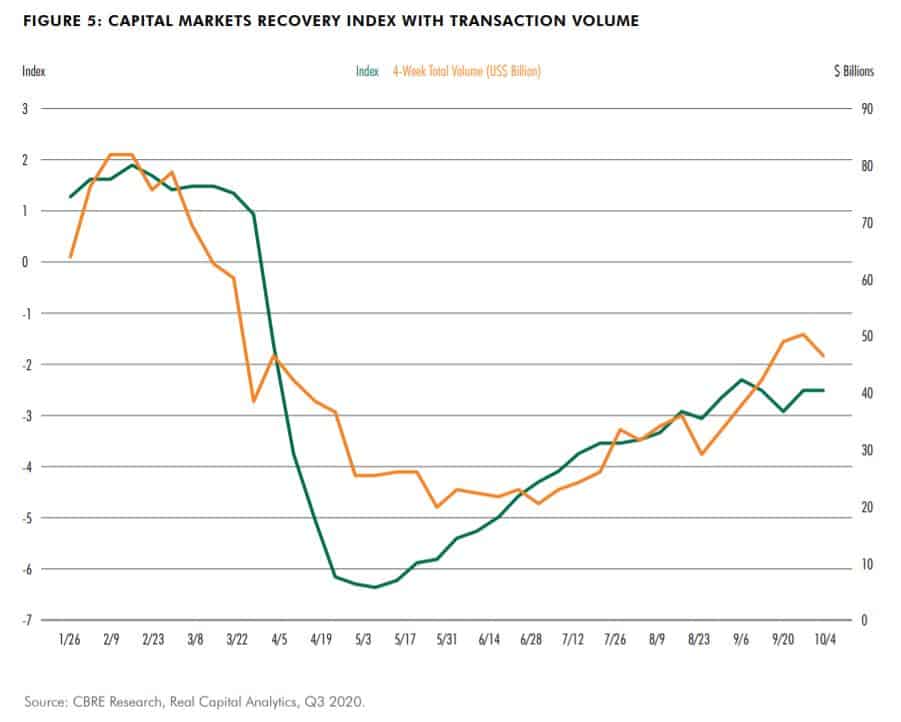

Hotel transactions and investments are on the rise, recovering back to regain a rate over half of what they were at the start of the year. We’re seeing a lot of hotels change hands, lots of new transactions, and a lot of new construction as well. Cap rates are also at historic lows, and are expected to maintain those lows through 2022. With such low rates and so many opportunities, many investors are in a perfect position to acquire properties.

The Path to Recovery

The biggest leading travel groups are business travel and group travel, and that may take a bit to fully recover. While so many businesses have adopted the zoom way of networking, and it absolutely is a way to cut costs, we believe that we are people oriented, and nothing can beat an in person meeting. There may be more virtual meetings than there were in 2019, but it will by no means be the majority of business dealings. Group travel may take more time to recover, but we’ve also already seen a rise in family group travels.

These next few months will be tough, but seeing the light at the end definitely provides a lot of hope. If you’ve ever got any questions about the market when it comes to purchasing, or the FF&E side of transactions, or even if you are putting preliminary budgets together to prepare for renovations, please don’t hesitate to contact us.