As the end of Q1 of 2024 rapidly approaches, we’ve seen and heard a lot of discussions relating to the state of the industry in terms of transactions. Just over a month ago at the ALIS conference, some of the big topics included discussions on the outlook of interest rates, transactions, and capital deployment and growth.

What can we expect to see for the coming year for investments, how are the current interest rates affecting hotel transactions, have the PIP renovations reached the end of their delayed schedules, and can we expect to see a ramp-up of transaction activity in the coming months? Let’s take a closer look.

The Outlook for Investments and Transactions for 2024

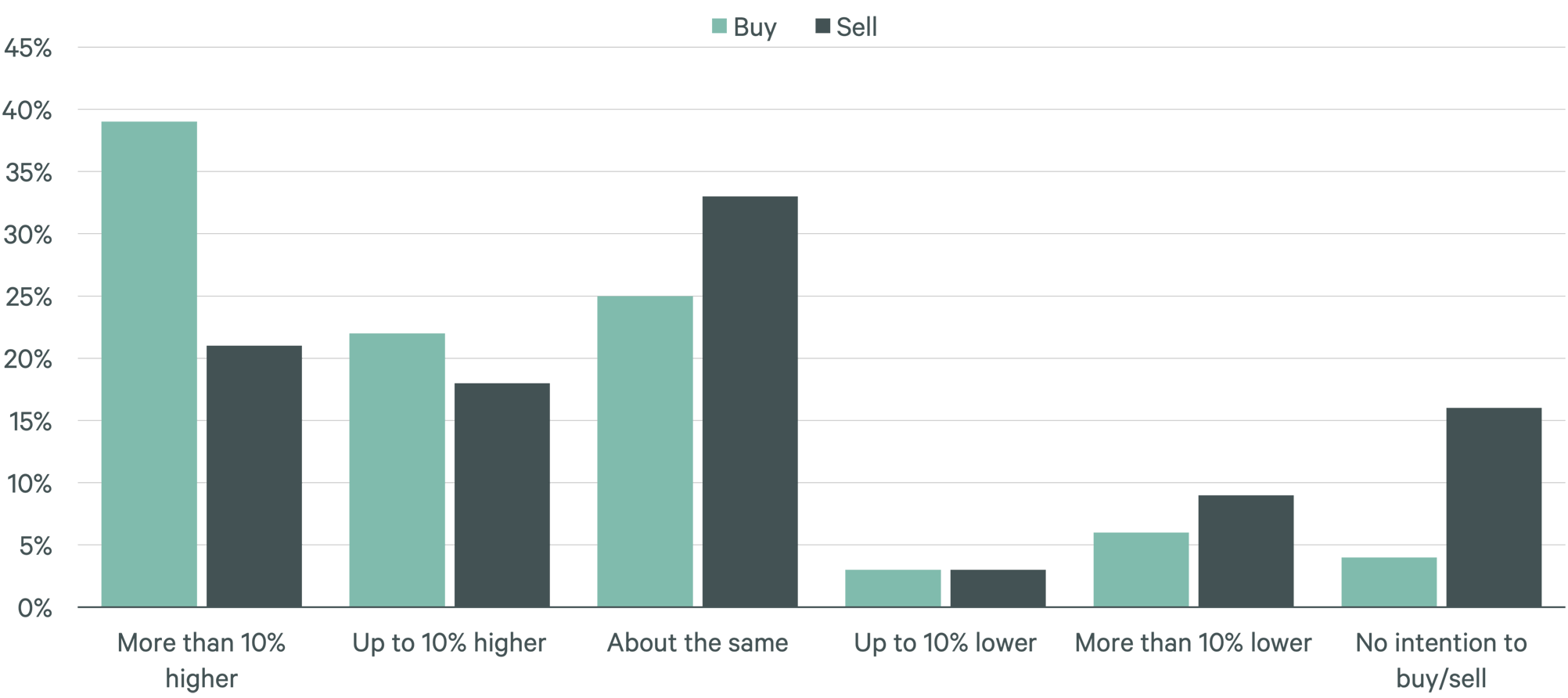

A CBRE Investor Intentions Survey released in January posed a very optimistic outlook for the coming year for investments and transactions.

“Over 60% of respondents expect to purchase more real estate in 2024 than in 2023, compared with only 16% in 2023 versus 2022. A higher percentage of developers, private equity funds, real estate funds and REITs plan to buy more assets in 2024 than other investor types.”

The chart below shows the investment activity expectations for 2024 and was included in the report. It is a great visual representation that the majority expect this year to be about the same or better than last year for investments.

Just over a month ago at the Americas Lodging Investment Summit, there was a specific panel to discuss the outlook of transactions for this year and the current state. Richard Stockton, president and CEO of Braemar Hotels & Resorts was there, along with several other hotel executives, to share his viewpoints. CoStar and Hotel News Now published a great recap of that discussion.

Richard Stockton touched on the issue of how many broken deals there were last year, and the sellers just testing out the market. As time has passed, we see more and more willingness to sell rather than try to hold out for the number sellers are looking for. “They’re no longer out there opportunistically testing the market to see if they can reel in a big number,” Stockton said. “I think that these are the days when that opportunity passed.”

In that same article, “An owner that wants to ride things out until their cash flow improves still likely has to deal with a debt maturity and renovation, said John Murray, president and CEO of Sonesta International Hotels. “You’re really committing a fair amount of equity into the deal if you want to stay in,” Murray said. “I do think that there’s going to be more activity coming as a result of that because some people have already held for five, seven years.”

We reached out to Brian Martin of BPM & Company, and he shared with us his thoughts. When asked if transaction activity would pick up in the next 12 months, he had a similar outlook. Brian said, “I believe it will pick up sooner than that. I do not think it will take much – 25 bps to 50 bps in interest rate easing – for the flood gates to open. We always hear about all of the ‘equity’ sitting on the ‘sidelines’. However given the slow pace of deals in 2023, I believe there is pent-up equity reserves. They are just waiting on that signal – that interest rate signal – that the Yield curve is going to swing back into a normal posture. That should happen at some point in 2024, likely before summer.”

Higher-for-Longer Interest Rates and Their Effect on Transactions

While there are definitely a lot of positives and less uncertainty going into this year, we are still seeing a steady interest rate and the expectation that it may stay around that range with little change. So with that in mind, we asked Brian Martin if he sees an effect that the current interest rate is having on hotel transactions. Brian said the following:

“I think it is pretty clear that both the environment, and rates themselves are stifling transaction activity. Let’s look at this very simply, if you believe that something is going to go down, and the market has been signaling this for some time, you are naturally going to wait for some signal before acting.

“The Yield Curve has been inverted for a long time now, so if you believe the market is properly pricing long term rates you also believe that the curve will come back in line. The 10-year Treasury is at +/- 4.3%. This indicates the markets believe that we are in the range of 2.0% – 3.0% inflation and that short-term rates should be between 2.5% and 3.5%. That is about 150 basis points of movement … but short-term rates driven by FED policy have stayed persistently above 5.0%. So, until you see signs that the Yield Curve is moving out of its inverted posture, why would you borrow now – unless you have to? If you are not borrowing, you are not buying.

“The second way that short term rates are curtailing transaction activity relates to simple math. Interest rates and cap rates tend to move in tandem, with some variance given to asset class risk. It can be argued that Hotels have seen a decline in relative risk (at least as compared to office) because of their rather low default rates and better performance over the past 24 months. However, even with a narrowing risk premium to the asset class, the cost of borrowing is still exerting strong pressure on cap rates. This pressure is keeping the bid / ask gap larger than it generally is in a normalized transaction environment.”

The Great PIP Problem: What is it, and where do we go from here?

We are now four years removed from the start of the COVID-19 shutdowns and everything that has followed, and we are now at the point where “The Great PIP Problem” has at become one of the hot topics of the year.

The IREFAC (Industry Real Estate Financing Advisory Council) during ALIS this year was packed with some of the top executives in the industry, sharing their thoughts, outlooks, and viewpoints. The panel included Marriott International CEO Tony Capuano, Accor Chief Strategy Officer and CEO of Orient Express Gilda Perez-Alvarado, Brookfield Managing Partner Shai Zelering, and Morgan Stanley Global Head of Gaming & Lodging Michael Bluhm. One of their topics, in addition to the activity outlook for mergers and acquisitions and transaction volume, was what they addressed as “The Great PIP Problem.”

According to this summary published by Hotel Investment Today, Tony Capuano of Marriott International addresses the complex situation. There is a need of course to protect the equity and the brands, but also it may require a unique approach. No two hotels are in the same situation and have the same needs, so he acknowledges the creativity involved to find a solution for each hotel individually, rather than a blanket ruling for all.

Shai Zelering of Brookfield sees it from a different point of view. “I would call it the deferred capex problem… Everybody thought going into this past three years that the big crisis will be debt maturities, but that has hasn’t happened. The squeeze will come from the deferred capex and we have to solve for it and in certain occasions it might mean reset the basis.”

Our question for Brian Martin was, are brands pushing PIP schedules or are they letting owners defer costs?

“This is of course a question that also relates to who the owner is.” Brian said. “The latitude given to a REIT or a major private equity firm is going to be far wider than that given to smaller ownership groups. That said, it has generally been my experience that so long as you are committed, have a plan and have demonstrated a track record of executing, at the end of the day most brands will work with your (within reason) on PIP scheduling. There are no free passes, but most of the brand folks understand the complications of the industry. So long as you keep within the scope and deliver the product they want, timing moderation is possible.”

The Overall Outlook

In summary, there is a lot to be optimistic about this year, and not as many factors of unknowns or uncertainties as we may have faced in the previous year. Experts expect the last half of 2024 to be huge in regards to the number of transactions. This could be even sooner if the interest rates drop even a little bit. There are properties that need to maintain standards, transactions that are waiting to happen, properties waiting for the right time for a conversion, and CapEx ready to be allocated towards property improvements or acquisitions.

When discussing the outlook of investors, Richard Stockton shared the following. “There are three main categories of hotel buyers: the real estate investment trusts, private equity funds and high-net-worth individuals and private companies. Last year, the REITs and private equity funds mostly took a step back, but now they’re starting to come back. The high-net-worth buyers are also interested.”

The desire is there, the market is ready, and we are excited to see what the remainder of the year brings. Thanks for sticking with us to the end of this in-depth discussion, and we’re happy to share any other insights we hear. We’re looking forward to the Hunter Conference, where we may have some additional updates.